20+ Second home mortgage

20 Down Payment in OR. Average Home Listing Price in OR 1.

10 Vs 20 Down Payment Long Term Savings R Personalfinancecanada

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

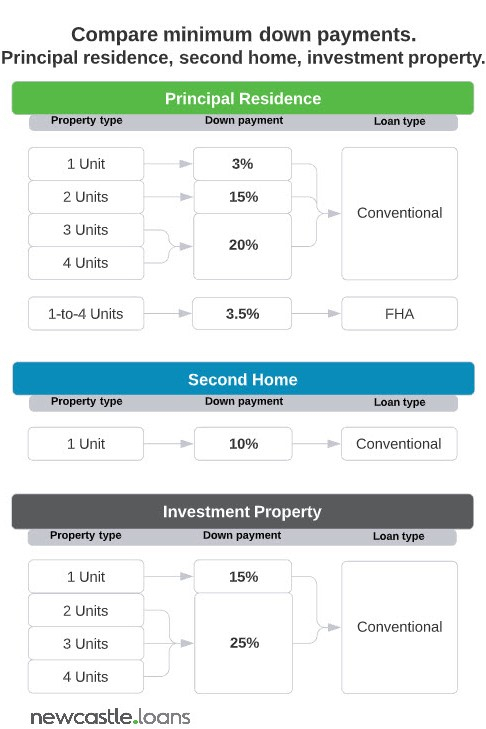

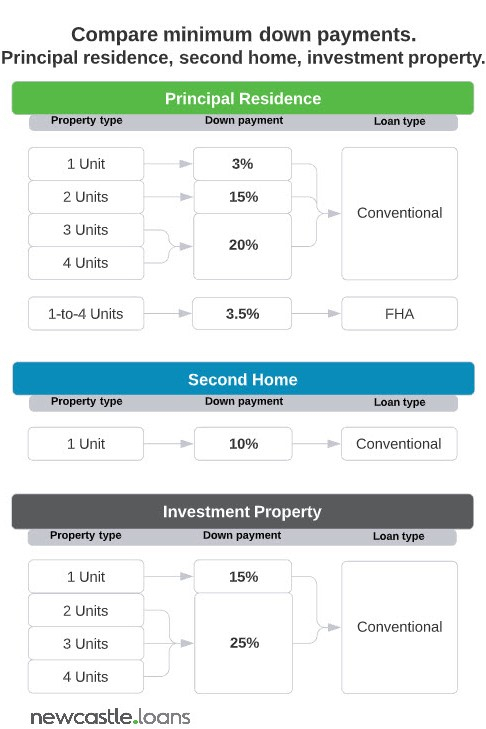

. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. How much deposit for a second home. A down payment of 25 or higher can make it easier to qualify.

Second Home Options Loan Amounts Up to 3000000. The mortgage rates on rental properties are typically higher than the rates for a primary home. Average Credit Score in LA 1.

Many second-home owners face big tax bills when they sell but there are ways to beat the capital gains trap. Home equity loans from Cannect start at just 499 but there are other fees associated with a loan. Also factor in maintenance and repairs.

A mortgage in itself is not a debt it is the lenders security for a debt. These fees are typically lower than our competitors and lower than fees you would pay to refinance your mortgagepotentially 10s of thousands of dollars lower if you need to break your mortgagewhich is why a CannectFlex loan may be right for you. Minimum Down Payment in LA 3 8970.

This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be able to claim an additional 175000 in interest from a second home meeting the IRS limit of 375000 in mortgage interest deductions. First Guaranty Mortgage Corporation offers mortgage loans for new home purchase and refinance. Minimum Down Payment in OR 3 15600.

We do not offer 95 LTV residential mortgages on second homes. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. If a person.

Jane is a dynamic leader with over 20 years of experience in the mortgage industry. 20 Down Payment in LA. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

While both loan types have similar interest rate profiles the 20-year loan typically offers a slightly lower rate to the 30-year loan. When stacking a 20-year mortgage against a 10- or 15-year mortgage it will take you longer to pay off the 20-year mortgage but the monthly payments will be more affordable. Average Home Sale Price in LA.

Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. You must repay the entire loan principal to retire your mortgage. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

A second mortgage is a lien taken out against a property that already has a home loan on it. On Saturday September 10th 2022 the average APR on a 30-year fixed-rate mortgage rose 8 basis points to 6007The average APR on a 15-year fixed-rate mortgage rose 8 basis points to 5202 and. Compare 20-year mortgage rates from lenders in your area.

A good rule of thumb is about 1 of the purchase price per year. Whether youre looking for your first home or a new investment property youve probably noticed a lot of terminology surrounding house styles and their structuresUnderstanding this terminology can help you find the home youre looking for foresee common issues for your home inspection and learn the benefits associated with certain home types. The minimum mortgage deposit you would need on a second home would be 10 ie.

If a client has a goal of paying off their home in less than 30 years a 20-year fixed is a good. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing insurance portfolio management finance and accounting personal investment and financial planning advice and development of educational materials about life insurance and annuities. Build home equity much faster.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. She oversees FGMCs Servicing Oversight. A 90 LTV mortgage.

What is a second mortgage. Mortgage rates valid as of 31 Aug 2022 0919 am. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis.

A lien is a right to possess and seize property under specific circumstances. We offer a variety of loan types including FHA USDA and VA. Maximum OR Home Buyer Grant 3.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Average Credit Score in OR 2. With a second mortgage loan you get to finance the home 100 percent but neither lender is financing more than 80 percent cutting the need for private mortgage insurance.

For example suppose you purchase a home for 380000 and put down 20 76000. Many people consider using their home equity to finance large financial needs but mortgage industry jargon has confused the meaning of certain terms including second mortgage home equity loan and home equity line of credit HELOCA second loan or. Making the Choice There are many advantages to choosing a second mortgage loan rather than paying PMI but the ultimate choice depends on your personal financial.

A second mortgage is another loan taken against a property that is already mortgaged. In other words your lender has the right to take control of your home if you default on your loan. Mortgage loan basics Basic concepts and legal regulation.

Our experienced journalists want to glorify God in what we do. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. If you repay the mortgage ahead of time youll save on interest charges but the lender may impose a prepayment.

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary homeup to 750000 if you are single or married filing. Maximum LA Home Buyer Grant 2. If you take out a 30-year fixed-rate loan for 304000 with a 5 interest rate.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. People typically move homes or refinance about every 5 to 7 years. How overpaying your mortgage by 20 a month can save thousands As rates climb.

A second mortgage and a home equity line of. If you have a lower credit score or higher debt-to-income ratio your mortgage lender may require at least 20 down for a second home. If youre looking for a buy to let second mortgage youll need a minimum 25 deposit or 35 if the property is a new build house or flat.

Six Things You Should Know Before Buying A Second Home Mortgage Propeller

Get The Lowest And Best Mortgage Rates In Just 90 Seconds

Mortgage Insurance Get Better Coverage And Lower Premiums Compare Home Quotescompare Home Quotes

The Ultimate Guide To Home Equity Loans Heloc Leap Financial

6 Reasons To Avoid Private Mortgage Insurance

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

You Re A Fool To Prepay Your Mortgage

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Top Milton Mortgage Broker More Options For You To Get A Top Mortgage

584 Second Mortgage Photos Free Royalty Free Stock Photos From Dreamstime

Mortgage Services The West Mortgage Group British Columbia

/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example

Perch Releases Innovative Online Tool That Provides Users With Real Time Mortgage Rate Quotes

Mark Wilson Mortgages Home Facebook

Dominion Lending Centres Sort Your Mortgage With Canada S 1

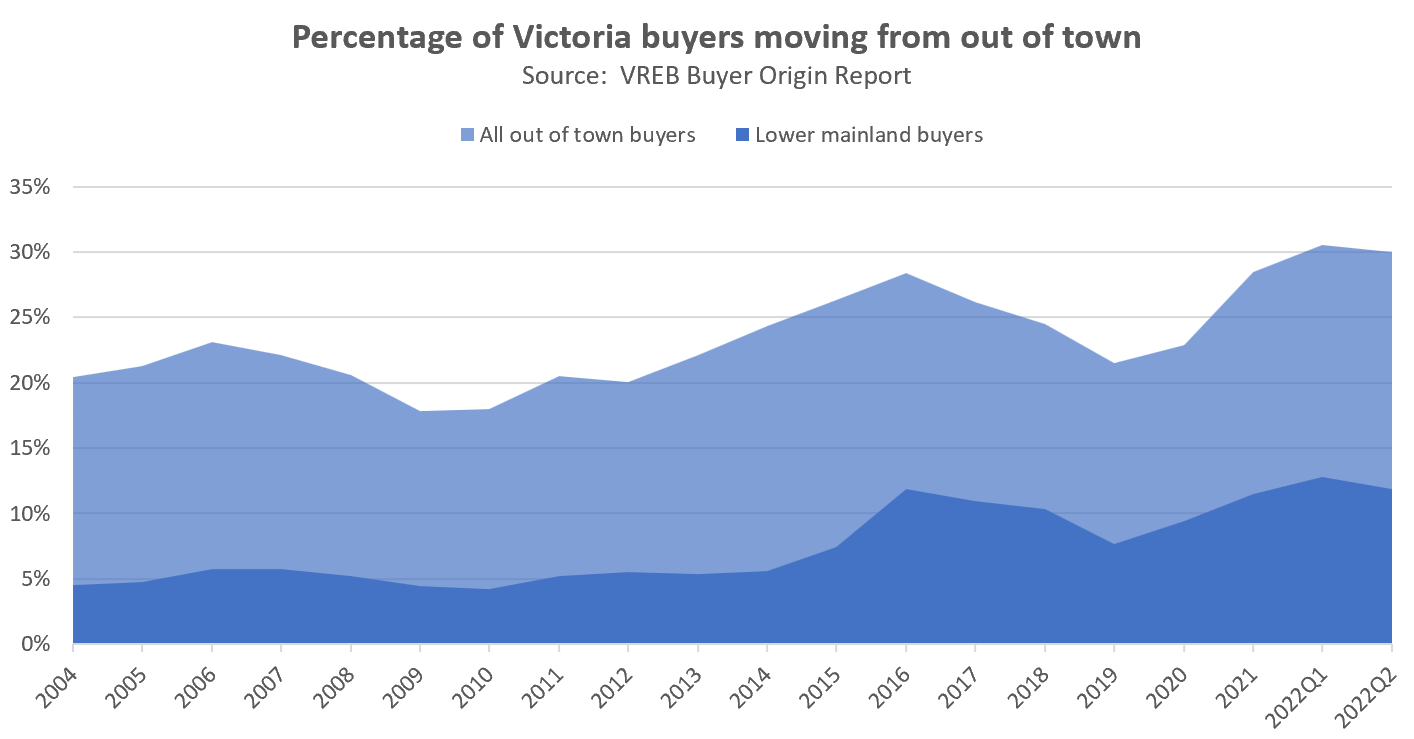

The Three Horses Of Housing Demand House Hunt Victoria

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage